Did you know that fintech apps have one of the greatest rates of retention in any category? The 90-day retention rate stands at 58% (far over the 48% baseline for other apps), while the yearly retention rate for these apps is 38%. This is due, in part, to the design of fintech apps.

Users send payments and check bank balances on a daily basis. Therefore, fintech apps are naturally utilized more frequently. However, the techniques and features used by the greatest fintech apps play a significant role in retention success.

So, if you are looking to match up to the bar or raise it further, then here are some important features of fintech apps that will help you improve your customer retention.

Features of fintech apps for better user retention

1. Sign in through biometrics

Making the app more engaging and entertaining isn’t the only way to increase user retention. Perception of security is essential in fintech. Since the user’s money is at stake with your software, they will abandon it in the absence of security features.

Biometric authentication is amongst the most effective app security solutions. The primary reason is that it is intrinsically more secure than conventional authentication techniques such as passwords.

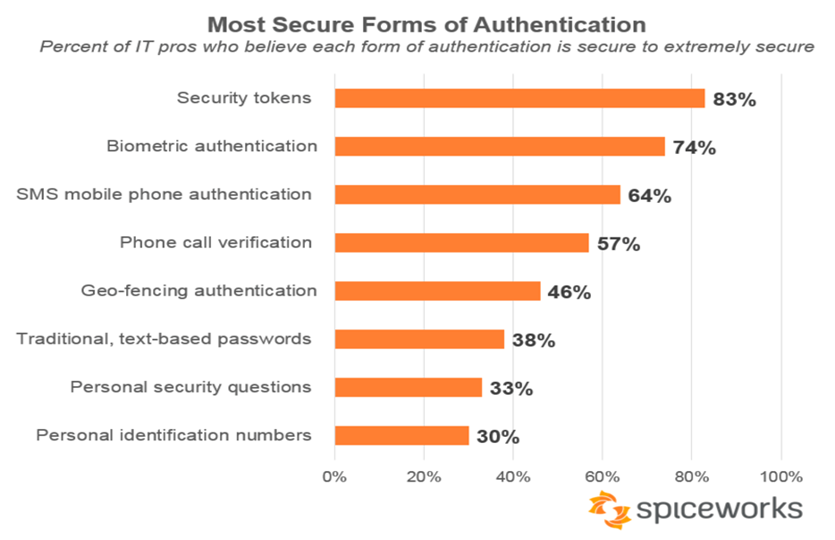

Indeed, biometrics is commonly used in high-security scenarios such as airport security and military apps. It’s the same in technology. Consider the following Spiceworks poll, which surveyed IT experts about the most secure ways of authentication:

2. Banking with voice assistance

Users may use voice commands to complete app operations using voice-assisted banking. Vocal-style technology is a new trend in online payments and fintech and has become more popular these days.

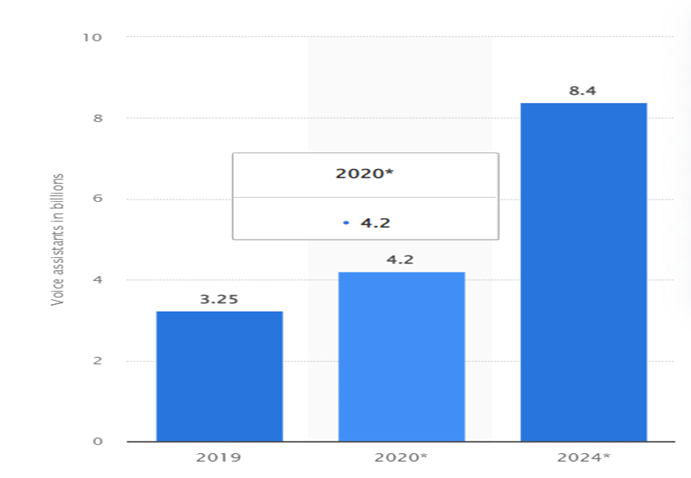

Digital audio assistance has grown in popularity with the introduction of Apple’s Siri and Google’s Alexa. Statista predicts that 8.4 billion smart speakers will be in use globally by 2024, representing a 258% increase from 2019.

Financial institutions and banks have begun to follow suit and incorporate voice commands into their apps. For example, the British bank, Barclays, enabled app payments via Siri.

3. User-centred navigation

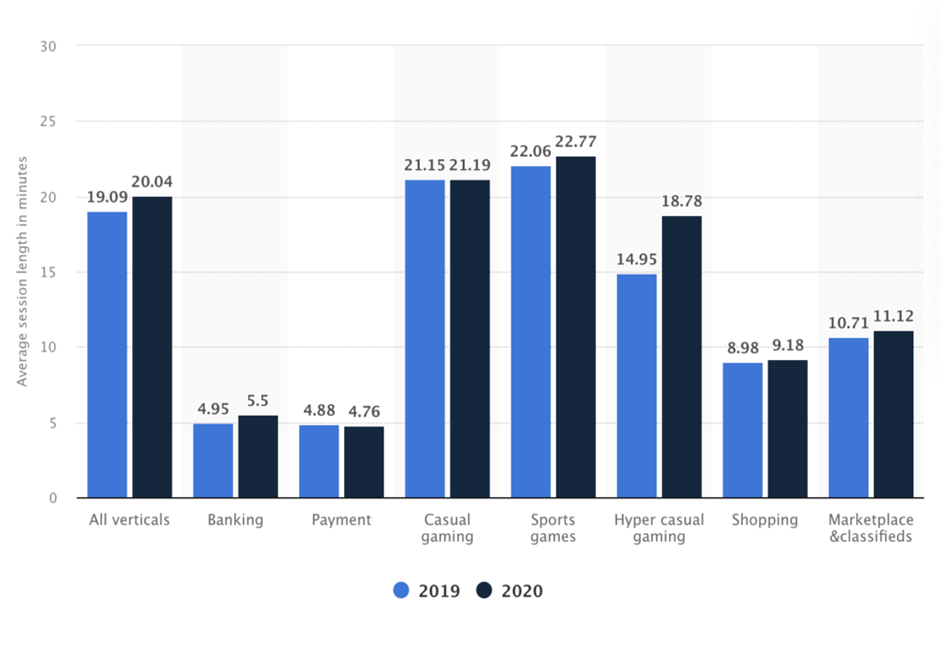

Every developer understands that simple navigation is a critical component of app engagement. However, many people are unaware that the purpose of navigation is to shorten the amount of time people spend using the app.

Of course, this depends on the circumstances. You’d want them to play for hours on end if it’s a game.

But in a financial app? Not at all. If people spend a lot of time navigating a financial app, it probably means they are having trouble finding their way.

Here is the average session length for different platforms, as depicted by a Statista study:

4. UI/UX customization

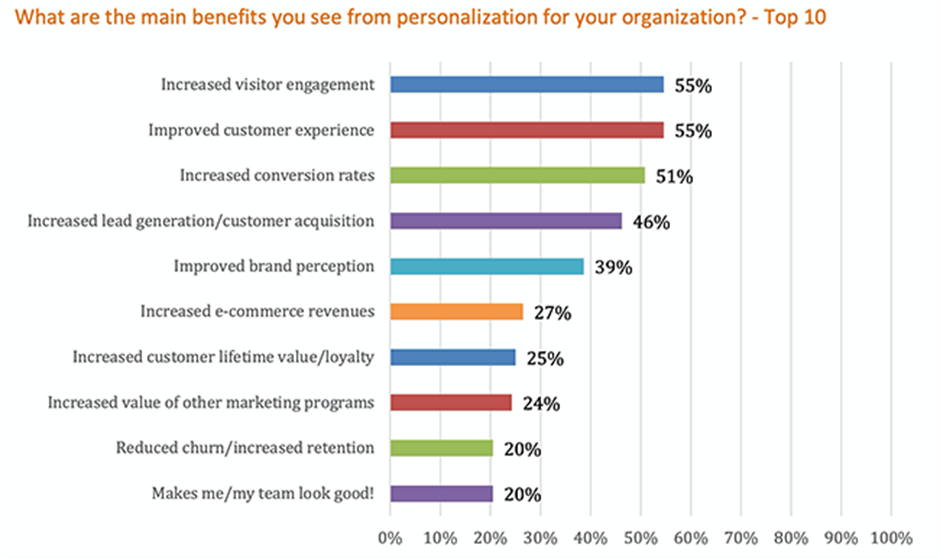

There is no better method to get consumers to utilize your software than to give them the impression that it was designed specifically for them. This is why personalization is critical for customer retention.

Customization has recently become one of the most popular marketing ideas, and for a good reason: it works. It can boost brand awareness and long-term loyalty in addition to engagement.

An app performs best in finance when it adjusts to each user’s journey and behaviour. Not only will the user feel appreciated, but it will also prevent information overload.

A chart-heavy screen, for example, will be appreciated by a seasoned stock trader. However, such a strategy will quickly overwhelm a novice investor.

5. Form design with no friction

Forms are areas of your app where users submit their information, such as transferring money or enrolling for an account. Maintaining as little friction as possible is critical for boosting UX—and retention.

Consistency is anything that prevents app users from moving between points A to B. In apps, this might be in the form of misleading content, small fields that are difficult to tap, or a crowded layout.

Error validation is a critical component of frictionless forms. Users will frequently make errors, and it is your responsibility to have the app respond as kindly as possible.

The ideal strategy is to identify mistakes in real-time, describe them in layman’s terms, and provide recommendations for correcting them.

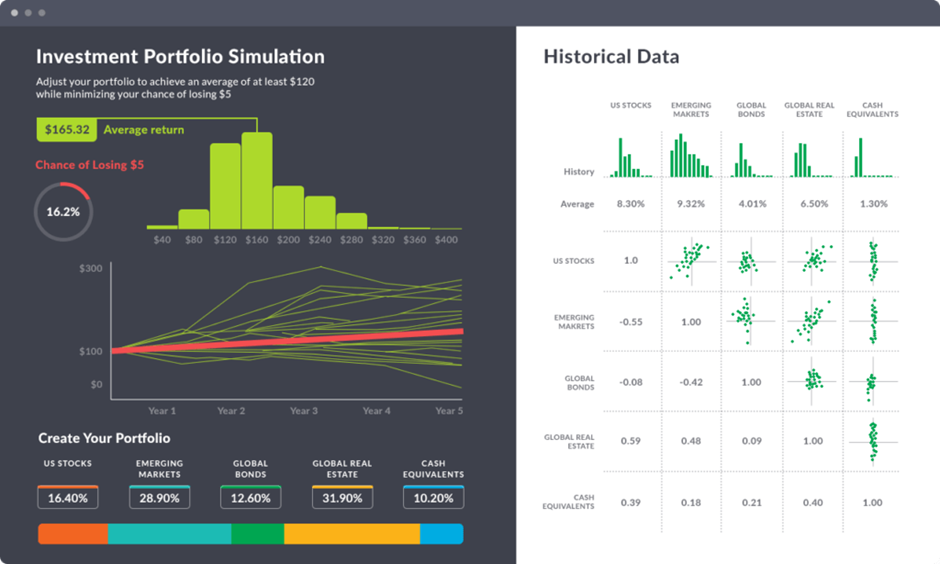

6. Visualization of data

Data visualization is an excellent driver of user experience and, as a result, retention.

Humans are visual beings. We absorb and comprehend information better when it is displayed graphically. As a result, a visualization is an essential tool for making complicated financial jargon more understandable to the user.

Consider having to digest this knowledge just through text:

Visualization can also help you spot trends and patterns. The Mint app, for example, graphs your account balances so you can readily notice extreme changes in your expenditure or income flow.

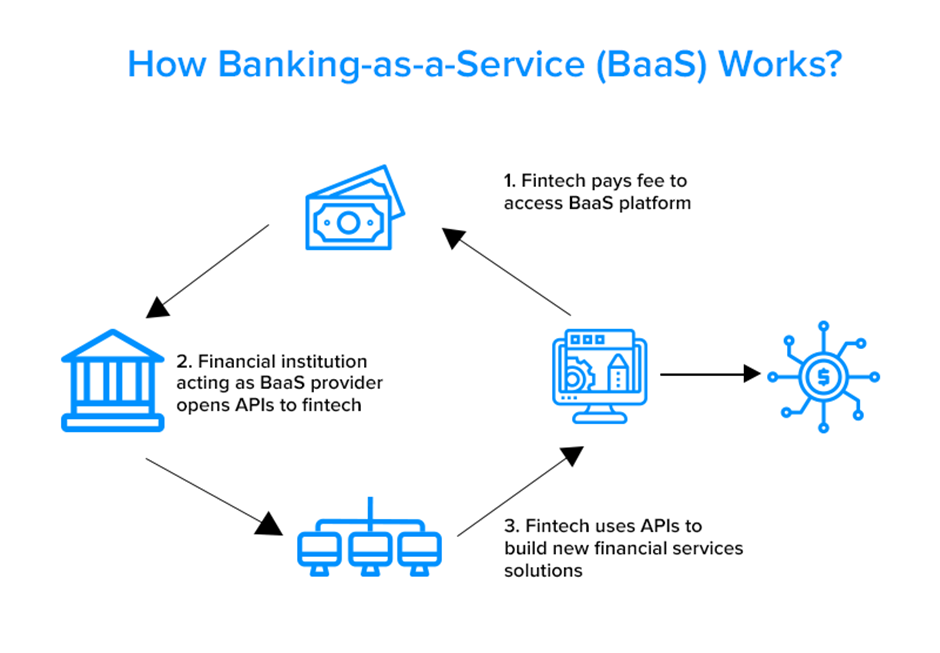

7. Integrations with APIs

By allowing you to add features that increase engagement, the right APIs and third-party solutions may do miracles for your user retention.

Integration is critical to the customer experience in many apps. Personal financial apps, for example, require access to a user’s savings accounts via the financial services program.

Without an API integration, the users cannot control their finances through the app, and the app loses its key selling feature.

Certain APIs are also critical for providing app functionality that would be difficult momentarily or impossible to provide otherwise. The Banking-as-a-Service (BaaS) architecture, which allows apps to leverage a bank’s current services, is an excellent example of this:

Another prominent example is Siri’s connection with apps like PayPal, which allows the developer to access complex capabilities without having to design them from scratch.

However, it is critical to remember the purpose of any app integration. Providing different features and tools simply because they are unique and exciting may not be the greatest strategy. This may, in turn, clog your app and dilute its purpose.

User retention revolves around the user—what will keep them on your app? Adding just APIs that suit this purpose is the best strategy.

Choosing the right partner for building your fintech app

Understanding the features and strategies of the most interesting apps is one thing. However, properly using them in your app is another.

That is why having the correct partner to build these services for you is the most critical aspect of your customer retention strategy.

So, if you have an app concept or require suggestions to boost your retention rates, please get in touch with an expert Fintech app developer who can help you build Fintech app development platforms for better user retention.